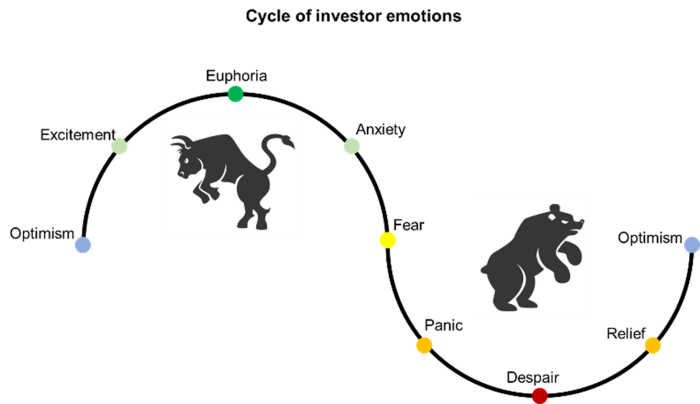

The following diagram shows the cycle of investor emotions. Take the time to study it. Investors may have all the knowledge they need about the markets and the companies on the stock exchange, have access to all the information on what is happening in the world, know the stock market history of the last 100 years, but this cycle of emotions has dictated the evolution of stock markets since their invention. And it will no doubt continue to influence the markets for the next 100 years.

Find me something that is not cyclical in this world. The economy is cyclical, although central banks, particularly the US Fed, have managed to reduce cycles since the 2009 financial crisis. Recessions are part of the normal business cycle – perhaps they can be delayed or made less severe by applying Keynesianism, but it is impossible to eliminate them in my opinion.

This is equally true of investor emotions, which invariably swing from euphoria to despair. Remember the bouts of madness that marked stock markets, especially the tech bubble of the late 1990s. Or the housing market euphoria of the mid-2000s that eventually led to the financial crisis of 2008-2009. In the years following this crisis, many investors simply gave up stock market investing.

There is no doubt that investor emotions had reached the “excitement” stage in 2020-2021. In some more speculative sectors, such as cryptocurrencies, the “euphoria” stage had probably been reached.

And today, after stock markets have crashed almost 25% from their highs, what is the emotional state of investors?

I would say it comes close to “fear” and “panic”. I do not know if or when we will reach the stage of “desperation”, which many observers also call “capitulation”. However, I know that we are much closer than a few months ago. If I may invent a new expression, investors today fear being “burned” by investing in the stock market. The phenomenon is now “Fear of Getting Burned” or FOGB!

In my opinion, instead of focusing on current events, news, and economic data – which will no doubt be negative – it is better to ask where we will be in several months, say 18 months. This is what stock markets generally do – they discount what is most likely to happen in the near future.

However, in 18 months, I believe that it is likely that the efforts of central banks will have succeeded in bringing inflation back to more reasonable rates. It is also likely that the economy will be on the way to rebounding from a difficult economic period.