A tempting proposition

Leo is a young man of 21 years old. On his birthday, he bought a lamp in a bazaar. When he got home, he rushed to clean it and, to his surprise, a genie escaped from the lamp. The genie had no wish to grant him but made him an interesting proposal. The genie said to him: “I am ready to offer you two million dollars today, in exchange for all your future pay checks.” Even though the offer seemed tempting, Leo was confused. Should he accept? To solve this problem, two elements must be considered.

1. His annual salary

The first step is to estimate his annual salary. How much money will he earn each year? Here is a hypothetical scenario. Leo will finish his studies in two years, so his income will start at 23. In the first years, his salary is likely to increase rapidly, as he will gain experience. In his 30s and 40s, he will potentially have a few promotions, which will accelerate his revenue growth. In his 50s, his salary might stabilize and grow at a rate that keeps pace with inflation. At 61, he will retire. Here is the salary path of such a scenario.

Based on this example, we estimate that Leo could earn an annual salary of $215,000 in 40 years. Some might find this annual income high, but it’s important to understand that $215,000 40 years from now is not the same value as $215,000 today. This point leads us to discuss the second element to consider; the discount rate.

2. The discount rate

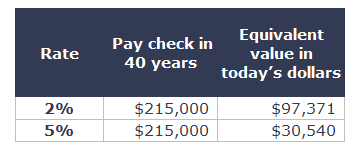

The discount rate is an interest rate that we will use to reduce all pay checks to today’s equivalent value. The table below illustrates two situations.

When we use a 2% discount rate, a $215,000 salary in 40 years is equivalent to a of $97,371 salary today. To help understand, if you earn $50,000 today and inflation is 2%, you will need to earn $51,000 next year to have an equivalent annual salary. Using a rate of 5%, $215,000 in 40 years is worth much less today – only $30,540.

The discount rate used is important because it causes significant variations in the present value.

Final calculation

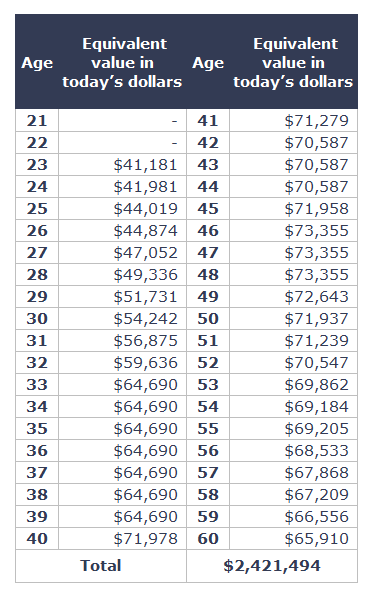

The final calculation is simply to discount all paychecks. In other words, we bring back all the pay checks as of today. Here is the value of each pay discounted at a rate of 3%.

Adding up all the years, we get a total of $2,421,494.

Factors to consider

As mentioned, the process is not complicated. The complexity comes mainly from the assumptions we make. Here are examples of situations that would upset our result.

- Leo does not finish his studies.

- He decides to go back to school at age 30 and has to quit his job.

- The company he works for closes.

- Leo decides to retire at 50 rather than 60.

- Leo fails to get a promotion.

- The discount rate used is not appropriate.

There are a multitude of scenarios that could improve or worsen the result. Despite these different scenarios, the assessment process remains the same.

Stock market valuation

Finally, let’s transpose this example to the stock market.

To achieve this, simply replace pay checks with the free cash flow (FCF) generated by a company. FCF essentially corresponds to the cash that remains after having operated the company and invested in its fixed assets.

Let’s imagine that the figures above are not those of Leo’s paycheques, but rather of FCF from Pizza Inc. Based on our assumptions, we could conclude that the value of Pizza Inc. stands at $2,421,494. In the stock market, this value is equivalent to market capitalization.

For the sake of simplification, I have intentionally omitted items that may alter the valuation process such as the value of certain assets or liabilities.

Conclusion

I invite you to try to estimate your own future pay cheques. If you find the exercise difficult, you will find that estimating the FCF of a company is even more difficult. This is why, in my opinion, it is preferable to focus on companies that are profitable, less cyclical and have a simple business model.

The level of complexity and uncertainty increases significantly when trying to estimate the FCFs of unprofitable, cyclical, or high-growth companies. Therefore, we increase the risk of getting a bad assessment.

By staying within their circle of competence, stock market investors can more easily anticipate risks and improve the accuracy of their estimates.

In summary, when you buy a stock market security, you are generally buying all of a company’s future free cash flow. The process is simple, but the assumptions and intricacies are many.