One of our portfolio companies that got the ball rolling is Netflix, which released its financial results on Tuesday, April 18, at precisely 4:00 p.m. (few companies are as punctual as Netflix).

I will explain how we approach the publication of the financial results of our companies, the work that we do for each of our portfolio companies.

At the outset, I must point out that we will rarely (if ever) make hasty decisions regarding any of our stocks upon the release of its results. The example of Netflix is striking in terms of volatility and the ambient noise surrounding the publication of results.

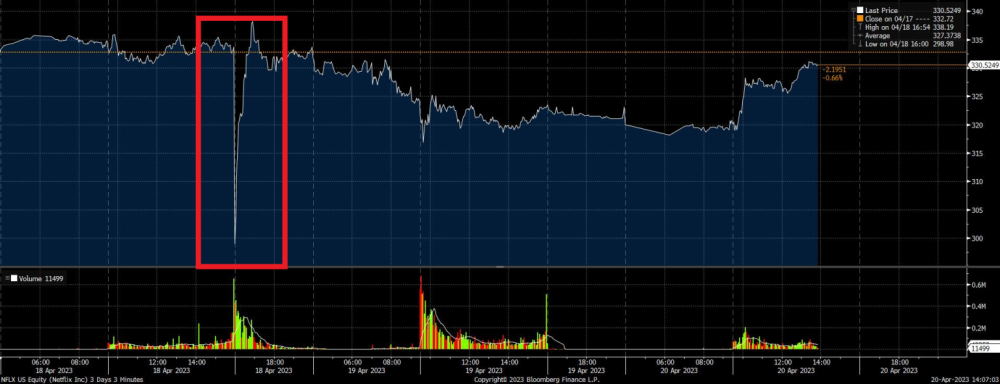

As I mentioned, Netflix released its results on April 18 at 4:00 p.m. However, in the second that followed, “after-hours” trading volumes on the stock literally exploded and the stock plunged by almost 10%, from about US$330 to just under $300 within seconds. Within minutes the stock was back up to $330.

How to explain such a fluctuation? I suspect these were trades initiated by high-speed computers that analyzed the highlights of the company’s press release to determine how the results compared to analysts’ forecasts (presumably, the number of subscribers to the service, revenue, and EPS). As these statistics were probably lower than expected, the computers made the near-instantaneous decision to sell the stock.

Our analysis process therefore has several elements:

1. Carefully reviewing the press release announcing the results of a company.

2. Updating our “financial statement” of the company. This spreadsheet presents the main financial data of the company and the evolution for several quarters, including revenue, operating profits, earnings, cash flow (including free flow) and the latest balance sheet.

3. Listening to or reading the management conference call with analysts and investors. Often, these conferences provide more “colour” regarding the activities of the company and the outlook for the coming quarters.

4. Reading the research reports of analysts who follow the stock. Most of the time, these reports will be released the day after a company’s financial results are released. We like to read these reports mainly to make sure we haven’t missed anything.

Once we have done all this, we adjust our forecast for the current year and make, if necessary, an adjustment to our valuation of the stock. A decision will then follow. Most of the time, it will be to keep our shares and do nothing; sometimes, it will either be to sell or buy more shares.

I doubt that an individual investor can compete with computer algorithms that instantly trade a company’s shares when the financial results are published. It is a losing proposition.

In my opinion, it is better to take your time and let the dust settle, and above all analyze well before making a decision concerning a stock. I also believe that this discipline of taking your time and always keeping a long-term horizon is an advantage for the individual investor in a world that is becoming more and more “instantaneous”.