As of February 22, the Nasdaq index, which is largely comprised of technology companies, is down 17.5% since its peak reached on November 22, 2021. Since the start of 2022, the index has lost 14 .5%. In this case, we are comfortably in a correction.

As for the S&P 500 index, it has fallen 10.7% since its peak reached on January 4. The 1% drop in this index on February 22 therefore officially put it in the “correction” phase. Since the start of 2022, the S&P 500 has lost 9.7%.

However, I have the distinct impression that a high percentage of stocks listed on the stock exchange are showing declines that are significantly higher than what these indexes might indicate.

In fact, this impression seems to be confirmed by a few statistics that I have observed over the past few days, in particular regarding the Nasdaq index.

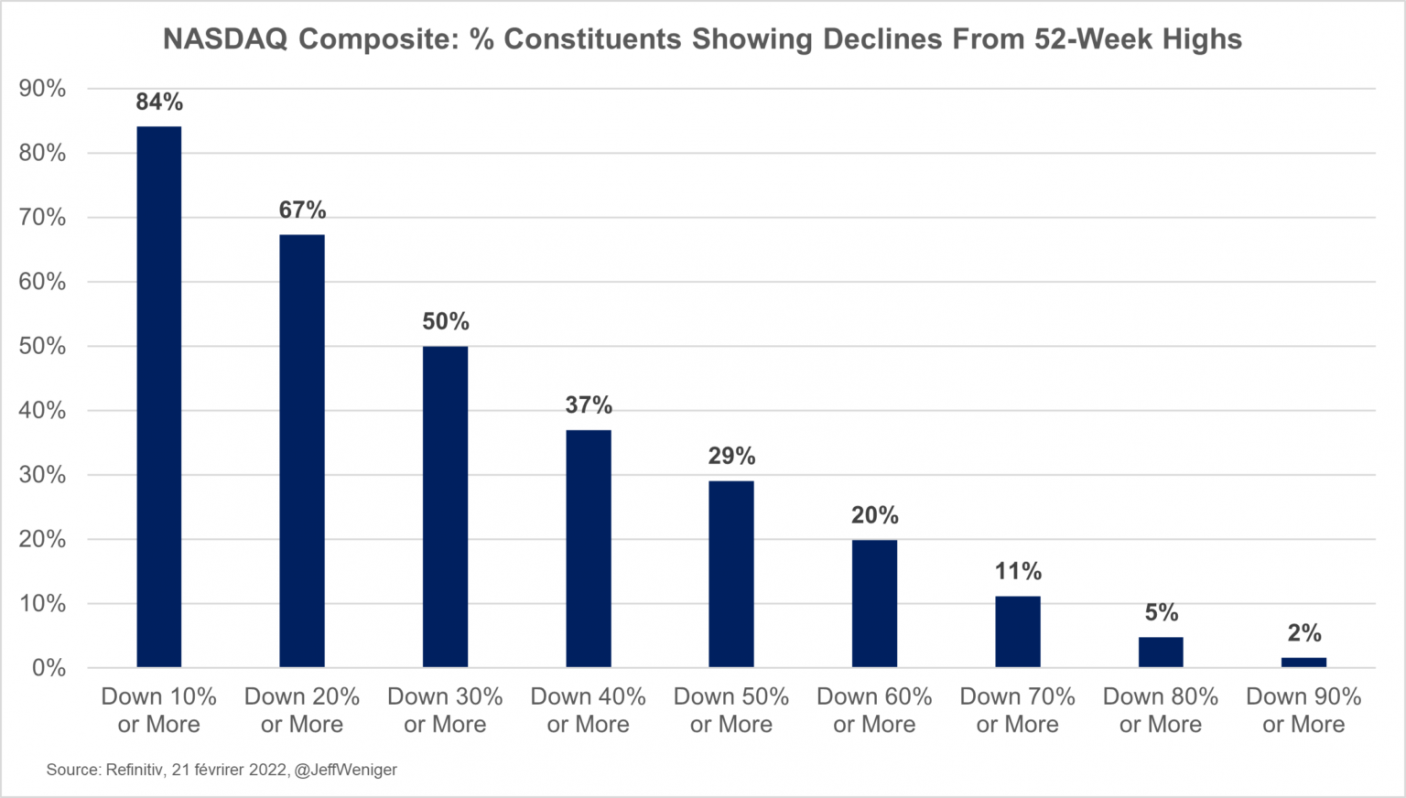

According to Refinitiv, as of Feb. 21, 67.3% of Nasdaq index stocks had fallen 20% or more since their 52-week high. Even more impressive in my opinion, 50.0% of the stocks in the index fell by 30% or more. The following graph is rather eloquent:

In my opinion, these statistics reflect two phenomena.

On the one hand, at the end of last December, the shares of Apple (representing 11.37% of the index), Microsoft (9.85%), Amazon (6.60%) and Alphabet (its two classes of shares combine a weight of 6.99%), four securities among the approximately 3,300 of the Nasdaq index have a combined a weighting of 34.8%. However, these four securities show an average drop of “only” 15.7% since their recent peaks. This means that the vast majority of securities listed on the Nasdaq have suffered much larger declines than those of these four securities.

On the other hand, there has been a lot of speculation in 2021 surrounding the securities of technology companies or whose activities are in “trendy” sectors. IPOs (initial public offerings), SPACs (Special Purpose Acquisition Corporations), “meme” stocks, etc., are all market segments that I believe have been subject to unbridled speculation. Overall, these market segments are the ones that have been hit the hardest in recent months.

In short, even though the main US stock indexes have posted marked declines in recent months, a large majority of North American securities have fallen significantly more than these indexes. Even if the media speaks of a “correction”, the reality experienced by most investors is that of a real bear market.