Over the following years, I have nevertheless noted a significant number of companies that have experienced significant stock market success following an acquisition strategy. In Canada, we only have to think of CGI, Alimentation Couche-Tard and Constellation Software.

In your opinion, do acquisitions really create value?

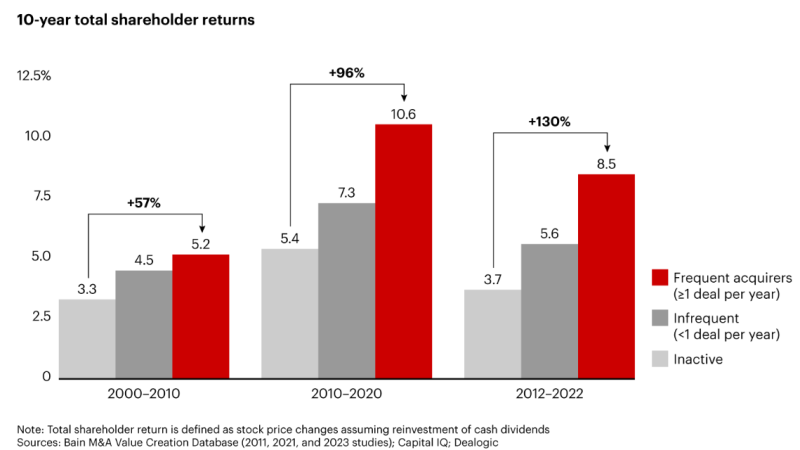

The article entitled “How Companies Got So Good at M&A” by Bain & Company certainly helps to shed more light on this. In it, the authors present the value creation achieved by frequent acquirers. In the table below, you will see that companies that make frequent acquisitions generate much more value today than inactive companies. This gap has widened over the last 20 years.

Source: https://www.bain.com/insights/how-companies-got-so-good-at-m-and-a/

The authors offer four reasons for this change. First, acquisitions at the time were mainly aimed at generating economies of scale and increasing the size of core activities, whereas today they also provide access to new markets or new technologies. In other words, the scope of acquisitions is broader and can lead to diversifying the service offering. In his recent biography, La passion du métier, Louis Vachon explains well that economies of scale, especially in regulated sectors, are difficult to achieve. Mr. Vachon explains than the concept of economies of scale is often misunderstood in business because it is not a one-dimensional concept.

Second, the due diligence process has greatly improved. In my opinion, access to technology is largely responsible for the improvement of this process. It is certainly easier today to communicate, analyze and compare to obtain a better evaluation of the target company.

Third, companies are making more acquisitions than before. Consequently, they are developing expertise in the field. The figures in the chart above clearly indicate this; there is a big difference between making few acquisitions and making them frequently. A company looking to make multiple acquisitions per year could equip itself with an exclusive team dedicated to this function. A well-organized firm with a team dedicated to acquisitions will certainly improve their expertise in the field.

Fourth, companies have learned by examining the failures of others that large-scale acquisitions remain risky. I invite you to list all the stock market companies you know that have had success on the stock market following an acquisition strategy. You will probably notice a trend. Many opts for small to medium-sized transactions, while the pace of acquisitions is quite frequent. In my opinion, this strategy greatly limits the risk.

According to the authors, these previous developments have significantly improved the success rate of acquisitions. In the 2000s, it was mentioned that nearly 70% of acquisitions were failures, while today, nearly 70% are successes.

I believe that the management team is an essential element to evaluate when faced with a company making acquisitions. The CEO and the Chief Financial Officer (CFO) are key elements. An investor should evaluate whether members of the executive have a history of successful acquisitions with their current or previous company. Besides the financial aspect, the opinions of customers, suppliers and employees should also be considered in assessing the success of an acquisition.

In closing, I hope that these lines will help you get rid of the myth of negative results from acquisitions. By identifying the characteristics mentioned above, you may increase your chances of identifying good acquirers now or in the future.

_______

Jean-Philippe Legault is Portfolio Manager at COTE 100.

His blog is published in