I cannot deny these facts. But are these good reasons not to invest?

Buying at the Peak

I must admit I have always had difficulty understanding the excuse of high market levels. Firstly, it is quite natural for an index to reach new highs on a regular basis. Over time, simply experiencing economic growth leads to an increase in corporate profits and consequently an increase in their stock prices. If you examine the very long-term chart of a stock index, you will notice that in reality, it consists of a series of new highs, repeatedly.

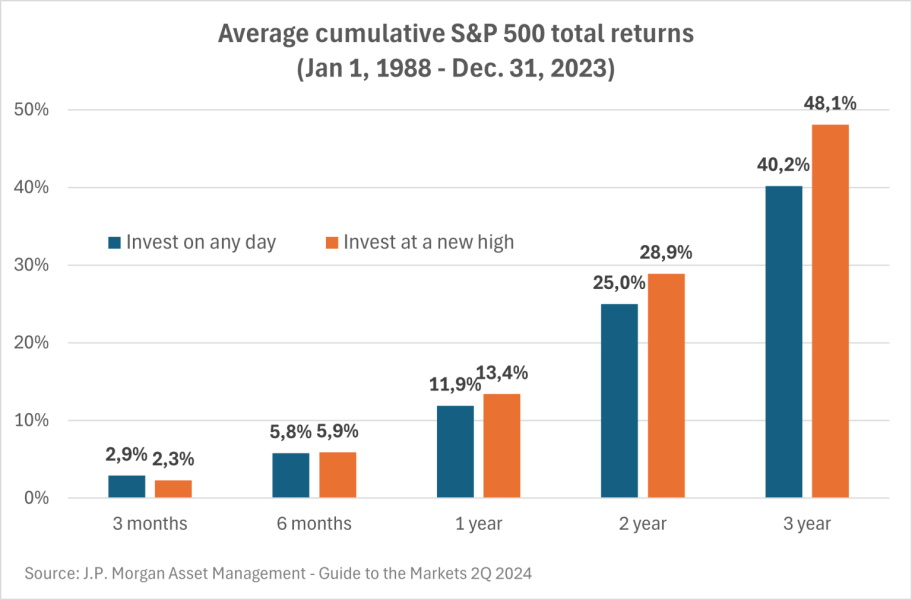

I recently came across a very interesting document produced by J.P. Morgan Asset Management in which they attempted to calculate the impact of investing at a peak. Here’s the result:

The columns “invest on any day” indicate that an investor who had bought the S&P 500 index every day between 1988 and 2023 and held the index for one year would have realized an average return of 11.9%. If they had held it for 3 months, their average return would have been 2.9%, while over three years their average return would have been 40.2%.

The columns “invest at a new high” redo the same exercise, but only on days when a new peak is reached. Thus, an investor who had invested only when the S&P 500 reached a peak would have obtained, on average, a return of 13.4% one year after their investment.

The results obtained are interesting. It can be seen that in the short term, a new peak is not a guarantee of superior returns. On the contrary, it is not uncommon to see the market take a pause or even pull back slightly in the months following a new peak.

However, in the long term, it would have been better to invest only at peaks. The most likely explanation for this phenomenon is that new peaks are often grouped together. Indeed, when markets surge, one is likely to experience a rapid succession of new peaks followed by a pause.

The idea here is not to encourage you to invest only when the market reaches a peak. My goal is to point out that the strategy of avoiding investing at peaks is futile.

High Valuation

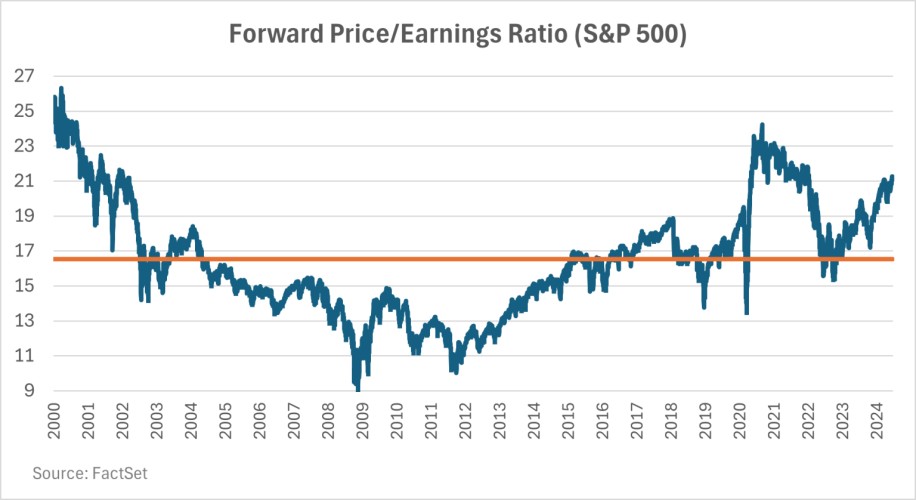

During our discussion, the previously mentioned investor also indicated that the market was “expensive.” To reach this conclusion, he used the forward price-to-earnings ratio of the S&P 500. Here is the ratio since 2000:

At 21 times forward earnings, the S&P 500 is certainly at a high level and significantly above its average of 16.5 times over the period. For comparison, the S&P 500 was trading at nearly 26 times during the tech bubble in 2000. Despite this observation, is it still a good reason not to invest?

I believe it is important to be cautious with this type of analysis. An important factor to consider is the influence that very large capitalizations have on the index. The most recent data indicate that the eight “megacaps” (Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVIDIA, and Tesla) account for 30% of the S&P 500. What’s more, the profits made by these eight companies represent 20% of the profits made by the S&P 500! Thus, these “megacaps” have a direct influence on the price-to-earnings ratio of the S&P 500. Without these eight companies, the price-to-earnings ratio of the S&P 500 would be about 18.4 times.

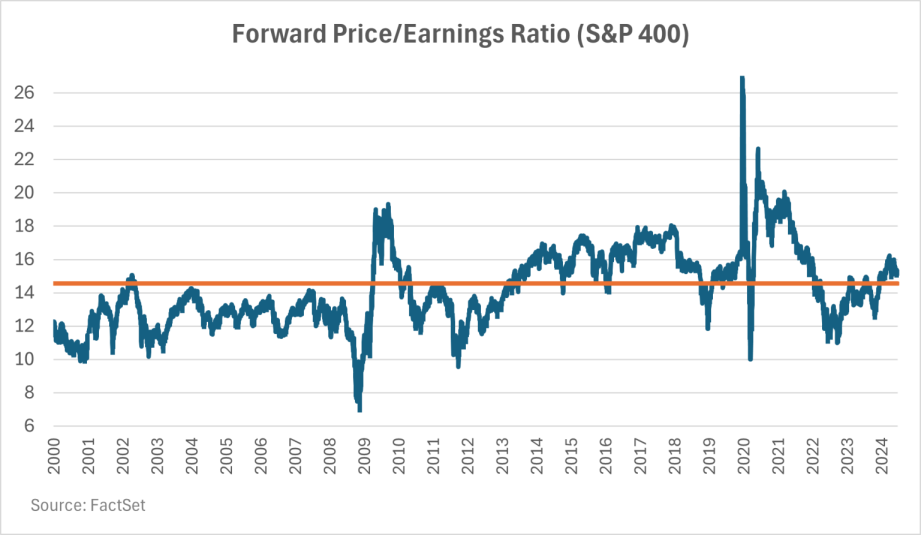

For a different representation, an investor might, for example, examine the S&P 400, a mid-cap index. The valuation is certainly closer to historical norms and does not seem overvalued as in the case of the S&P 500.

The objective here is not to comment on whether the market is expensive or not. It rather serves to caution investors so that they do not put all stocks in the same basket. Not all stocks are expensive, and generalizing would be a mistake.

An investor following an index strategy has no choice but to be carried by the market, both upwards and downwards. However, selecting individual stocks, as we do at COTE 100, offers the flexibility to avoid certain stocks or sectors that seem overvalued. Even if the market is at a peak, there are opportunities to invest. You just have to look!

_______