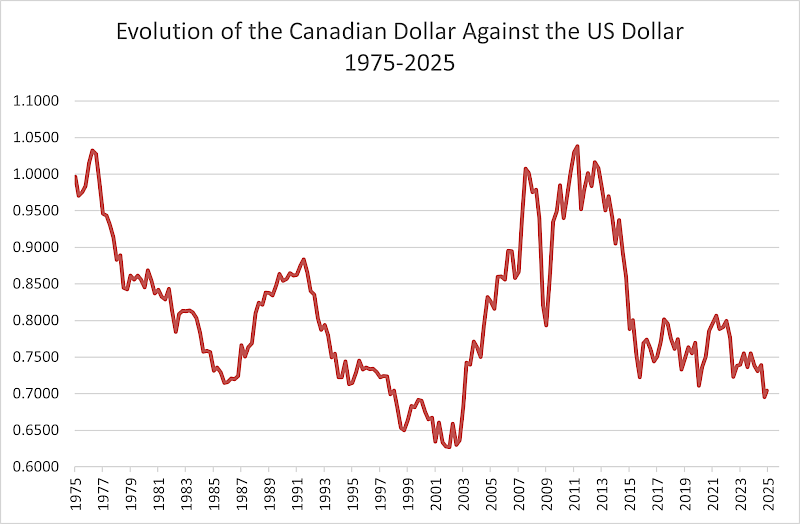

For me, the recent weakness of our currency against the U.S. dollar largely reflects the risks and uncertainty associated with Mr. Trump’s appointment as President of the United States. Since he officially won the presidential election on November 5, 2024, the Canadian dollar has depreciated by 2.9%. Since the end of September 2024, it has lost 4.8%. His tariff threats are devaluing our currency.

What are the impacts of a weak Canadian dollar for various stakeholders, consumers, businesses, and the Canadian economy as a whole?

The first observation I would make is that the Canadian dollar, like all values traded in a free market, generally adjusts quite quickly to economic and geopolitical realities. Thus, the weakness of the Canadian dollar against the U.S. dollar somewhat counteracts the potential tariffs proposed by Mr. Trump. At this time, we cannot be certain that tariffs will be imposed and, if they were, what their extent would be and which products they would target. However, I believe that the imposition of widespread punitive tariffs would likely cause our currency to fall further, which would partially offset the negative effects of Mr. Trump’s tariffs.

Indeed, a sharp decline in the Canadian dollar against the U.S. dollar makes the exports of our Canadian companies even more affordable for Americans.

Moreover, many stakeholders strongly recommend that we buy local, Quebec, or Canadian products and avoid American products. The motivation behind this recommendation is entirely commendable, but market forces exert such pressure that there is no need to wonder whether a product is Canadian or American. In fact, a weak loonie will quickly make all products from our southern neighbor increasingly expensive.

The same phenomenon applies to Canadian snowbirds who used to spend several months a year in the warmth of Florida or California. I am convinced that the weakness of our currency will put greater downward pressure on snowbird demand than any advertising campaign promoting the beauty of the Canadian winter.

For businesses, as I mentioned, those that have built their business model on exporting to the United States will benefit from a weaker Canadian dollar. However, their costs will also rise, as most purchase equipment or raw materials in U.S. dollars. This is a problem because our Canadian businesses will need to increase their productivity, which has been declining for many years and remains far behind that of American businesses. In the long term, local businesses cannot rely on the protection of a weak Canadian dollar but must find ways to become more efficient—artificial intelligence will surely be an avenue to explore.

For Canadian investors who hold shares of U.S. companies in their portfolios, the weakness of the Canadian dollar (or the strength of the U.S. dollar) has been favorable in recent months and years. I believe that the recent frictions between Canada and the United States should further highlight the need to diversify investments, both in Canada and worldwide.

Finally, at the macroeconomic level, the weakness of the Canadian dollar is likely to put upward pressure on prices, which could drive up the inflation rate. In such a context, it becomes more difficult for the Bank of Canada to lower interest rates.

Philippe Le Blanc, CFA, MBA

Chief Investment Officer at COTE 100

_______