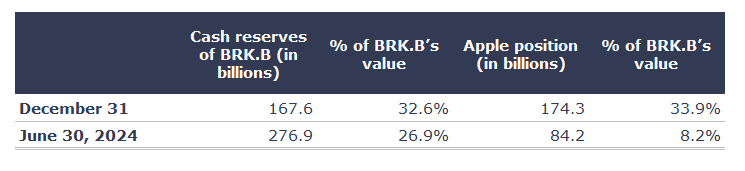

As a result, the company’s cash reserves increased from $167.6 billion to $276.9 billion during this period.

To put these figures in perspective, the market capitalization of Berkshire Hathaway, whose stock has appreciated by about 34% since the beginning of 2024, now exceeds $1 trillion. It was approximately $514 billion at the end of 2023.

Thus, from December 31, 2023, to June 30, 2024, the following changes can be observed:

What to make of this decision? Does it mean Warren Buffett fears a major stock market correction? Does he believe stock markets are overvalued? Has he lost confidence in Apple?

Many articles have been written on this subject.

I am not privy to inside information, far from it! However, we have been Berkshire Hathaway shareholders for nearly 10 years, and I have read almost everything Buffett has written, as well as most of the books about him. I have also attended most of Berkshire Hathaway’s annual meetings for over twenty years. So, I believe I understand Buffett’s philosophy.

In my opinion, the primary reason for the partial sale of Apple shares is a reduction in risk for Berkshire Hathaway’s shareholders.

Buffett has often emphasized that Berkshire Hathaway has exceptional shareholders, many of whom have held shares for many years, even decades. Over time, these shareholders have realized exceptional returns and have thus accumulated a substantial investment in Berkshire Hathaway, often representing the majority of their wealth.

In the 2023 annual report, Buffett writes that his sister Bertie embodies his view of the company’s shareholders: “Bertie, and her three daughters as well, have a large portion of their savings in Berkshire shares. Their ownership spans decades, and every year Bertie will read what I have to say.”

That is why I believe Buffett significantly reduced the company’s position in Apple. As of December 31, 2023, this investment represented 33.9% of the company’s total value. After the sale (and the stock’s rise), the investment in Apple accounted for about 8.2% of the company’s value.

One could also assume that Buffett considered Apple’s stock to be too expensive at the end of 2023 and since then. However, such considerations have rarely been the reason for past sales, as demonstrated by Berkshire’s investments in Coca-Cola or American Express, two stocks that became relatively expensive in the past, but that Berkshire never sold.

In my opinion, Buffett made the wise decision to significantly reduce the level of risk for his sister Bertie and all the other shareholders she represents in his mind.

Philippe Le Blanc, CFA, MBA

Chief Investment Officer at COTE 100

_______