However, I do know that Nvidia’s stock has delivered an extraordinary performance in the market over the past few years, to the point where the company recently became the largest in the world!

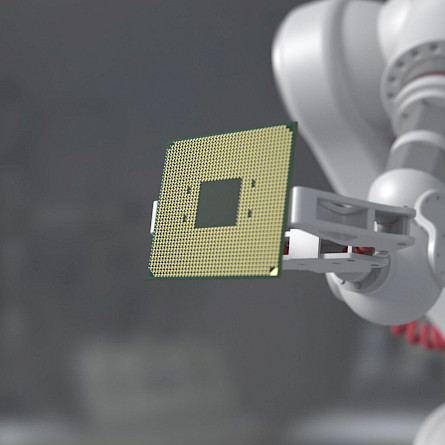

I also understand that the company has benefited from massive investments by tech giants like Microsoft, Google, and Meta Platforms to develop artificial intelligence (AI) solutions. Since Nvidia’s high-performance chips appear to be the most advanced in the industry, demand for them has literally exploded in recent years. As a result, the company generated over $63 billion in net profit in the past 12 months. For comparison, Nvidia reported revenue of $60.9 billion in January 2023.

However, Nvidia’s stock—along with several other companies closely or loosely tied to AI—has dropped in recent days. The unexpected announcement of a Chinese AI platform called DeepSeek, which is said to use significantly fewer Nvidia chips, has shaken investor confidence in the company’s outlook. Overnight, the long-standing narrative that businesses will heavily invest in high-capacity chips to develop AI seems to have been fractured.

On closer reflection, two key phenomena have emerged.

On one hand, when the planets align, as seems to have been the case for Nvidia in recent years, it raises the question of whether such a situation is sustainable. Can we really assume that the business model of a company that generated less than $17 billion in revenue in 2020—and that analysts predict will surpass $196 billion in 2026—is sustainable? And that a company with after-tax profit margins of 26% in 2020 (already well above the average) could achieve a margin of over 56% in 2025? Maybe—but I have my doubts.

And what about the stock’s valuation? At its recent market peak of $150 per share, it was trading at around 34 times its projected 2026 earnings.

Apparently, on February 28, seven planets in our solar system (Venus, Mars, Jupiter, Saturn, Uranus, Neptune, and Mercury) will align in the sky. According to ChatGPT, such an alignment happens only once every 170 to 200 years. In my mind, Nvidia’s business model has benefited from a similarly rare alignment of the planets within its industry in recent years.

On the other hand, necessity is the mother of invention. The recent emergence of a powerful new AI tool that requires fewer chips perfectly illustrates this saying. Since 2022, the U.S. government has imposed strict restrictions on the export of advanced AI chips to China. In doing so, hasn’t the U.S. government shot itself in the foot by pushing Chinese companies to develop an AI application that relies on other chips or fewer advanced chips? Could this be another example of “unintended consequences”?

The months and years ahead promise to be fascinating and eventful, but also highly unpredictable—especially in the field of AI.

Philippe Le Blanc, CFA, MBA

Chief Investment Officer at COTE 100

_______