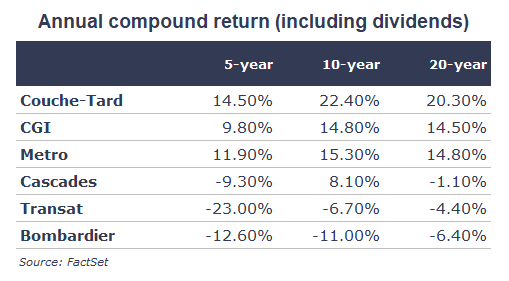

On the other hand, if a security has had anemic or negative returns over 5, 10 or 20 years, you have probably identified a company of questionable quality.

Here are some telling examples from Quebec companies:

Such a test may be simplistic, but it has the advantage of being objective. Isn’t the job of business leaders to create value for their long-term shareholders? If a stock hasn’t done anything worthwhile for the last 20 years, either they’ve done a poor job or the industry the company is in isn’t attractive. Whatever the reason for the underperformance, it is in my opinion a stock that a long-term investor should avoid.

There may be an exception to this rule. Some securities may have been badly affected by currency fluctuations over the past many years. Indeed, if there is one element that the managers of a company do not control, it is currencies. This phenomenon is easier to notice these days, as several currencies, including the Euro and the British Pound, have fallen against the US Dollar.

The phenomenon is well illustrated by the shares of Diageo, a British spirits producer. If we assess the appreciation of its share in US dollars (its share is traded on the New York Stock Exchange in the form of an ADR [American Depository Receipt]), we see that the compound annual returns of the share are respectively 4.8%, 3.8% and 6.9% over 5, 10 and 20 years (without taking dividends into account). Such performances seem rather mediocre.

However, if we examine the performance of the stock on the London Stock Exchange, in pounds sterling, we see that the compound annual returns for the same periods are 8.0%, 7.6% and 8.6% respectively. Not great, but still more attractive than US dollar data, especially when you add dividends to those returns.

If the exercise is useful for helping an investor to separate the wheat from the chaff with regard to potential investment candidates, it is just as useful for evaluating the securities in a portfolio. We know how difficult it is to objectively assess the performance of securities that we already own. We all have this tendency to be more lenient with the securities of the companies we own, especially those that we have owned for many years. We all “fall in love” with some of our holdings.

I therefore suggest that you calculate the compound annual returns of the securities you own over the periods of 5, 10 and 20 years (if such periods are applicable). I went through the exercise for the securities we hold in the portfolios under the management of COTE 100. I conclude that the majority of our securities have provided us with excellent returns over the past many years. On the other hand, the exercise allowed me to identify some securities of companies that are frankly dragging their feet.