Here is a concrete example using results from Stantec (“STN”), a company held in our managed portfolios. The company provides engineering consulting services.

For the 2021 fiscal year ended December 31, Stantec reported diluted net earnings of $1.80 per share. This figure is obtained using IFRS accounting standards. However, in the press release announcing its results, the company mentioned that it achieved diluted and adjusted net earnings per share of $2.42. To arrive at this figure, the company had to make several adjustments, such as excluding certain acquisition expenses and write-offs.

We believe some of these adjustments are reasonable, but not all. As a result, our in-house calculation of net earnings comes to $2.15 per share.

We believe it is important for an investor to review the adjustments and make up their own mind about what should or should not be included. At its recent price of $63, Stantec’s stock traded at 35 times IFRS earnings, but 26 times adjusted earnings. That’s quite a difference!

Generally, we adjust earnings by excluding exceptional or non-recurring items that are not related to the current activities of the company. We assume that these elements will not recur in the coming quarters. Here are some examples of items that we typically exclude from our calculation:

- Costs generated by an acquisition;

- Expense for commercial litigation;

- Gain or loss on sale of assets;

- One-time restructuring costs;

- Write-off of the value of a division.

Conversely, we generally do not exclude expenses that appear to be part of a company’s normal course of business, even if they do not affect its cash flow. Here are some examples:

- Stock compensation expenses;

- Ongoing restructuring costs;

- Part or all of the amortization of intangible assets.

I agree that all of these exceptions may seem complex. How to make sense of them?

My advice: as much as possible, avoid companies that make a lot of adjustments. This will reduce the risk of being wrong and overestimating the actual profits made by a company.

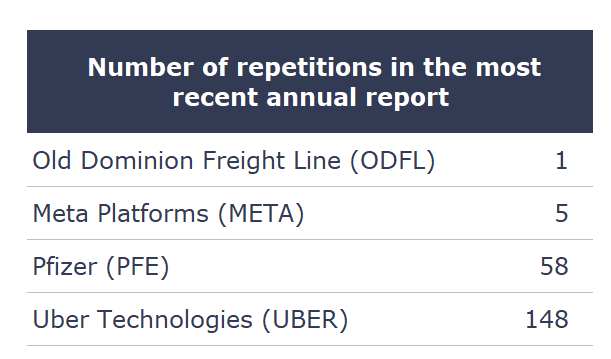

Here’s a trick to quickly identify the adjustments. Open the most recent annual report or press release outlining a company’s recent financial results. In these documents, count the number of times the word “adjusted” appears (an easy way is to use the Ctrl + F function on your keyboard).

Here are some examples of securities that we do not hold in our portfolio:

This exercise makes it possible to quickly identify companies whose financial results are more likely to be overvalued by their management.

As much as possible, allocate your time to companies that are stingy with their earnings adjustments.

Jean-Philippe Legault, CFA

Financial Analyst