This is an element that I consider paradoxical for long-term investors, including myself. How to reconcile one’s desire to keep a security for several years (at COTE 100, we keep ours on average for more than seven years) with the publication of quarterly financial results? After all, three months is a very short period for the leader of a company on the stock market. However, we all know that a company’s financial performance is scrutinized every quarter by investors and analysts and that violent stock market fluctuations may occur the day after the publication of quarterly results that are not in line with expectations.

Yet many executives, particularly those with a large equity stake in the company they run, have demonstrated that they can ignore analysts’ expectations and focus primarily on creating value for their shareholders over the long term.

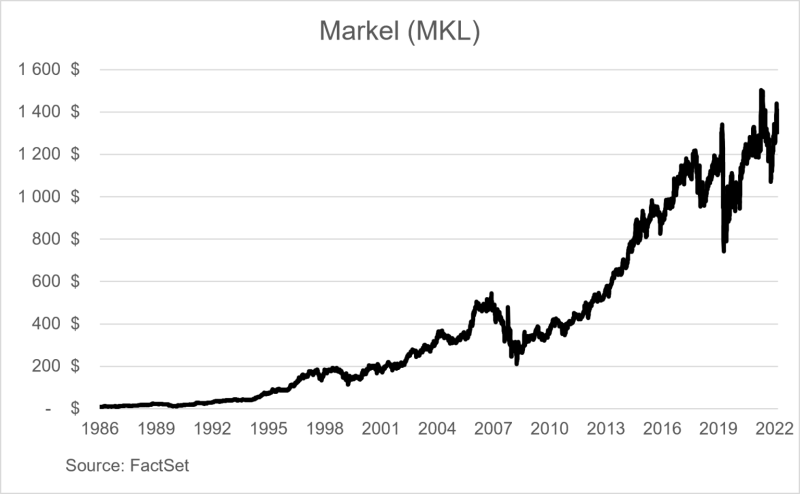

Recently, while reading the transcript of the conference call following the release of the Markel (“MKL”) annual results, a company we hold in some of our managed accounts, I realized that certain companies seem to have succeeded in reconciling the apparent contradiction that exists between rigorous and efficient management of their business in the short term and the creation of value for all shareholders in the long term.

Here is what Mr. Tom Gayner, CEO of Markel, had to say about it on the call:

“As a public company, the cadence of these calls is every 90 days. Each quarter, we share our financial results with you as we hold this call. While we update you one quarter at a time, let me assure you that is not the cadence we follow in managing Markel. Our North Star remains the dual time horizon of forever and right now. We believe that the combination of the long-term time horizon embodied by the concept of forever, coupled with the discipline and urgency of the right now provides a balance that serves us well.”

This way of seeing things as presented by Markel’s president makes it possible to reconcile what seems contradictory: living in the present moment and investing for the long term. In the world of the Markel leaders, the dual time horizons of the immediate and the long term are aligned, to the benefit of the company’s long-term investors.

When faced with a business decision, a manager should always choose the actions that are likely to add to the value of their company in the long term and reject those that would reduce it, even if they could be beneficial in the short term.

When we review the quarterly financial results of our portfolio companies, it is to ensure that their leaders continue to build their company and create long-term value. The issues that can cause a company’s quarterly results to fluctuate are generally small, as long as the company continues to make progress toward its longer-term goals.