Recently, Mr. Donald Trump stated: “The United States does not need Canadian cars, lumber, or oil.”

Such a statement makes no economic sense in my view. It is true that the United States has vast resources, but even if it could be self-sufficient—which is not the case for all resources—it would still be advantageous for the country to trade with other nations like Canada.

Trump appears to be steering the country toward what is known as economic autarky, thereby reducing its international trade. This concept takes me back many years to my first economics course. It reminds me of the comparative advantage principle from my Macroeconomics 101 class.

The concept of comparative advantage is not new. It was introduced in 1817 in his book Principles of Political Economy and Taxation by economist David Ricardo and forms the foundation of the economic globalization that has transformed our planet over the past two centuries. This concept states that each country benefits from specializing in the production of goods for which it has a comparative advantage in terms of productivity or cost relative to its trading partners.

Thus, even if a country is less efficient in producing all goods compared to another country, it can still benefit from trade by specializing in goods where it is relatively less inefficient. This theory supports the idea that free trade is beneficial to all participating countries, as it allows for a more efficient allocation of resources and an overall increase in wealth. This is what I would call a win-win strategy. However, this theory becomes less valid if tariffs are imposed between two countries.

A Simple Example Illustrating Comparative Advantage

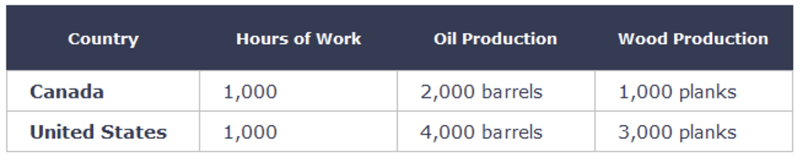

Let’s take two countries, Canada and the United States. In one hour of work, an employee in each country can produce the following (these numbers are fictional):

- In Canada, in one hour of labor, an employee can produce either 2 barrels of oil or 1 plank of wood.

- In the United States, in one hour, an employee can produce either 4 barrels of oil or 3 planks of wood.

For both products, you will notice that the United States has an absolute advantage over Canada (the productivity difference is exaggerated, but the U.S. is still significantly more productive than Canada). However, this does not mean that the U.S. should produce both wood planks and oil.

According to the theory, each country would benefit by specializing in the production of the good for which it has a comparative advantage.

To understand this concept, we need to consider opportunity cost, which represents the benefits lost when choosing one production alternative over another.

In our example, the opportunity costs for each country would be as follows:

- In Canada, producing 1 plank of wood has an opportunity cost of 2 barrels of oil, while producing 1 barrel of oil costs 0.5 plank of wood.

- In the United States, producing 1 plank of wood has an opportunity cost of 1.33 barrels of oil, while producing 1 barrel of oil costs 0.75 plank of wood.

By comparing the opportunity cost of producing a barrel of oil in both countries, we see that Canada’s opportunity cost is lower than that of the U.S., meaning that Canada has a comparative advantage in oil production, while the U.S. has a comparative advantage in wood production.

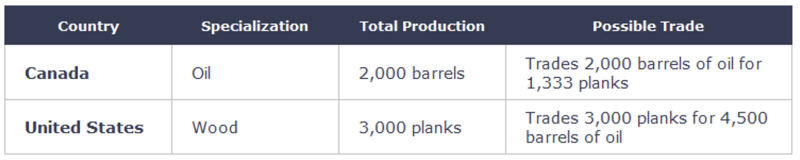

Therefore, Canada should specialize in oil production, while the U.S. should specialize in wood production.

For trade to be beneficial to both countries, the terms of trade must be set between their respective opportunity costs—that is, between 1.33 and 2 barrels of oil per plank of wood. In our example, we will assume a trade ratio of 1.5 barrels per plank.

Comparing Autarky to Free Trade

Suppose each country has 1,000 hours of labor per year. In an autarky scenario, Canada could produce either 2,000 barrels of oil or 1,000 planks of wood. The United States, on the other hand, could produce either 4,000 barrels of oil or 3,000 planks of wood.

The following demonstrates that trade between the two countries would be beneficial to both compared to an autarky scenario.

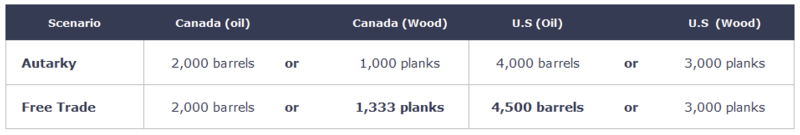

Autarky Scenario:

Here is a possible scenario under free trade between the two countries:

Theoretical Gains from Trade

As shown in the table above, both countries would benefit in a free trade scenario.

Indeed, in an autarky scenario, Canada has the choice to produce 2,000 barrels of oil or 1,000 planks of wood. However, in a free trade scenario, Canada could produce 2,000 barrels of oil and trade them for 1,333 planks of wood, gaining 333 extra planks. The same applies to the United States, which would benefit from a gain of 500 extra barrels of oil in a free trade scenario.

This is a somewhat technical throwback (sorry) to my university days. The key takeaway from this theoretical exercise is that free trade enables a more efficient allocation of resources and an overall increase in wealth, benefiting all participating countries.

We can therefore see that Mr. Trump’s desire to impose tariffs on imports from Canada and Mexico would be detrimental to all involved parties—not just Canada and Mexico, but also the United States itself.

Philippe Le Blanc, CFA, MBA

Chief Investment Officer at COTE 100

_______