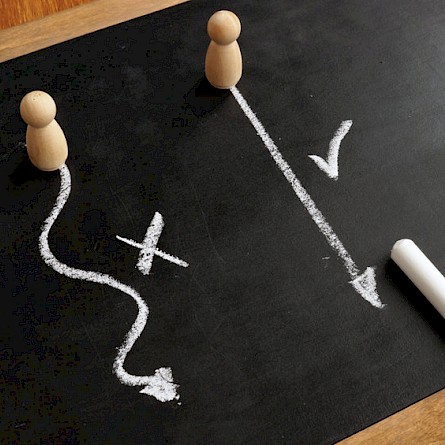

It is certain that an investor can make things particularly complicated. One has only to put in place stock option strategies for the level of complexity to explode. Some will try to set up “long-short” strategies which consist of buying securities for part of their portfolio (“long”) and selling securities “short” for another part. Others will try to multiply transactions each day, trying to take advantage of very short-term trends in securities or other types of investments.

Some will succeed with such strategies, but I sincerely believe that in the long run simplicity in investing will beat complexity every time.

The best example is probably Warren Buffett. What he has managed to do over the last fifty years is a feat, but it is nevertheless of a disconcerting simplicity: buy quality securities at reasonable prices and keep them for a very long time.

The best investment advice is also very simple. Although it may seem simplistic, the wisest advice is to be patient, not to rush your decisions, to remain disciplined at all times.

Indeed, the world of investment and the stock market is infinitely complex. It is illusory to believe that you can reduce or eliminate this complexity by increasing the complexity of your investment process. On the contrary, I believe that the best way to reduce this complexity is to reduce this process to its simplest expression.

Here are some ways to do it:

- Most investors should invest in stock indices such as the S&P 500 or the S&P/TSX. Those with the knowledge, time and discipline can invest in stocks themselves, but they should do it the Buffett way: by patiently choosing stocks of quality companies at good prices and holding them for the long haul, and by adequately diversifying their portfolio;

- Think long-term and accept short-term stock market volatility;

- Disregard politics, geopolitics, and the economy;

- Do not attempt to make predictions;

- Have realistic return expectations: Buffett, probably the best investor of modern times, has achieved compound annual returns of almost 20% during his career – do you really believe that 30% is within your reach? The stock market’s historical return of nearly 10% is a more appropriate benchmark;

- Minimize transactional, management and tax costs.

To succeed in the stock market, the difficulty does not lie in the method to adopt; rather, it comes from the discipline, perseverance and patience required to apply it rigorously for decades.