More specifically, mental models allow concepts from external fields such as psychology and history to be used in order to apply them to investing. By making such parallels, the investor risks better understanding and, above all, anticipating the course of certain events.

To illustrate this point, here is an example using the field of biology. This example is inspired by a passage from Andrew Chen’s book, The Cold Start Problem.

Meerkats

Meerkats are small animals that live in southern Africa. They usually live in groups of 20 to 50 members. To protect themselves, meerkats use sentinels which, raising themselves on their hind legs, scan the horizon in search of predators. As danger approaches, the members are warned and run for cover. In addition to protecting themselves, meerkats also hunt collectively.

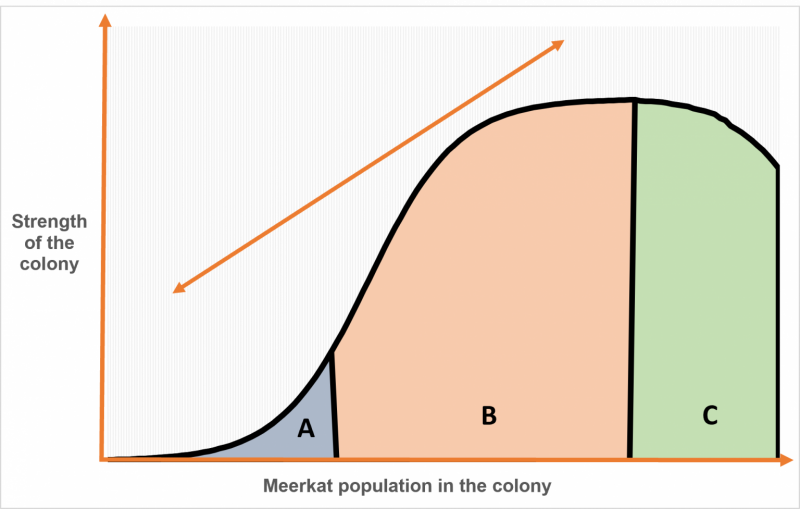

The size of the colony is crucial for the survival of the group. Indeed, a small colony of meerkats will not be adequately protected. A group of three to six meerkats, for example, is at greater risk of losing one to a predator. Such a loss then accelerates the destruction of the group. Thus, the survival rate of a small group of meerkats is low. The weakness of its community network is illustrated in section A of the graph below.

It is only from a certain point, say between 10 and 12, that the collective effect takes on its full meaning for the colony. Being now well protected, the colony will be able to feed properly and to reproduce. Thus, the arrival of new members in a well-established colony will drastically improve the strength of the community and the prospects for survival of the group. This rapid improvement is illustrated in section B of the graph.

At some point, the efficiency of the colony will peak, and the strength of the network may even decline. This situation occurs in the case of overcrowding. The decline could be caused by a lack of food or space in its environment. A large group also provides multiple targets for predators. This peak is illustrated in part C of the graph.

The network effect

This simple concept that comes from biology now allows us to better understand the functioning of the network effect found in many companies.

The network effect is generally associated with companies or platforms such as Facebook (META), Uber (UBER), YouTube (GOOG), Dropbox (DBX), Bumble (BMBL) and eBay (EBAY), where the addition of a member improves the strength of the network. For example, a network consisting of 50 active Uber cars in a region is much stronger than a network consisting of only two active cars.

The example of the meerkats is interesting for understanding the dynamics of the network effect, but it is probably even more so for anticipating the course of events.

Investors who understand the phenomenon well will realize that it is difficult for an embryonic network to develop. The risk of failure for a company at this stage is high.

They will also understand that at a certain point, the network could quickly gain strength. A well-established and healthy network reduces risk and generally improves prospects for growth and profitability.

However, unless there is a change, this strength will eventually peak before declining. The investor will understand that overcrowding is not necessarily beneficial to the network.

It is important to understand that the network effect can also work in reverse. If a network gradually loses members, its strength could quickly erode. Blackberry, Nokia or MySpace are examples of companies that suffered this fate.

If investors own companies benefiting from a network effect, they should closely monitor those that are in phase C of the graph above. The analogy with meerkats could potentially help them identify networks that are deteriorating and anticipate the impact on their business model and profitability.

Besides the network effect, are you able to draw other parallels between biology and investment?

Jean-Philippe Legault, CFA

Financial analyst