Please note that I am not saying that buying a stock is a simple process. On the contrary, the purchase of a stock requires long analyses. However, after going through an exhaustive process, it is generally quite easy to decide whether the stock is a buy or not. For example, imagine that you are analyzing a quality company, with interesting growth prospects, with limited risks and offered at an attractive price. If this stock is more attractive than the worst company in your portfolio, the decision to buy becomes obvious. The problem is that these companies are rare, and it takes a lot of work to find them. This scarcity is the main reason why we trade infrequently in our portfolios.

The decision to sell is usually much more difficult. In my view, the reasons for selling a stock can be divided into two categories: valuation and fundamentals. Often, the decision to sell or hold can be different if only one of these categories is used. Let’s examine them.

Valuation

There are several ways to establish the valuation of a security. The approach we favour at COTE 100 is to use valuation multiples, such as the price/earnings ratio.

Between 2011 and 2021, we have made the decision to make 20 significant sales in the portfolios of our private management clients. In his recent book Avantage Bourse, Philippe Le Blanc revisits some of these decisions. I decided to do the exercise again, but from a different angle. Here is my observation.

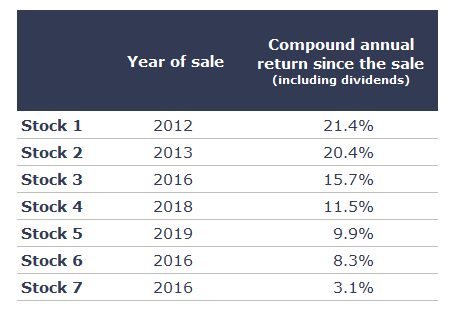

Of these 20 decisions, seven were dictated by the valuation. In other words, the main reason for the sale was related to the stock’s rise and a significant premium to our valuation. Here is a recap of the seven sales where I present the compound annual return of the stock from the date of the sale until today.

Although it is a small sample, the conclusion of this analysis seems clear. It is generally unprofitable to sell a security based solely on valuation.

Stock 3 is McDonald’s (“MCD”). It was bought in 2011 when it was trading at nearly 15.0 times expected earnings, a valuation ratio we thought was attractive. By January 2016, the stock had soared and was now at almost 22.0 times expected earnings. This valuation, which at the time seemed high to us, had been a significant factor in our decision to sell. Although we managed to make a respectable 43% gain over this period, we have to admit that it would have been better to keep the stock.

Experience has taught us that quality companies are often “expensive”. In our view, sell decisions should instead be based on company fundamentals.

Fundamental Data

An investor’s job should be to identify the significant changes that are taking place in a society. Here are some of the questions we ask ourselves that could lead to the sale of a company:

- Is its existing position threatened by new competitors or a change in the industry?

- Are the long-term growth prospects altered?

- Has the level of debt increased significantly, reducing flexibility, and increasing risk?

- Have key executives left?

- Has the strategy adopted by management changed drastically?

This non-exhaustive list gives a good overview of what should be considered when making a sale decision. Caution, a sale decision based on the fundamental characteristics of a company is not necessarily a guarantee of success every time.

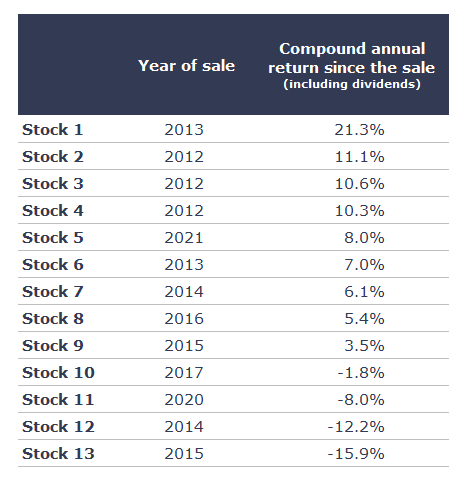

As can be seen in the table below, some stocks we sold on this basis continued to perform well. Of course, business model analysis is, in our opinion, more subjective than valuation analysis, which inevitably leads to errors. However, this process has allowed us to avoid holding several stocks that have experienced anemic returns and even to avoid some substantial losses.

In closing, this methodology should not necessarily be applied with absolute rigidity. Stock market investing is more of an art than a science where every situation is different. Selling based on a valuation can make sense in certain situations, such as excessive overvaluation. That said, a stock investor should remain cautious about using valuation as the primary reason for a sale.