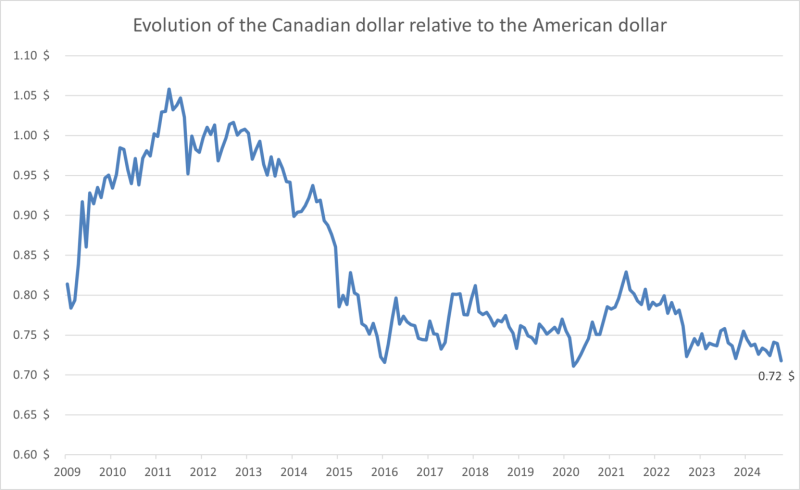

Firstly, the Canadian dollar is currently at a low relative to the U.S. dollar. Here is the evolution of the Canadian dollar (the “loonie”) against the U.S. dollar over the past 15 years:

However, the weakness of a currency alone isn’t a strong enough reason to invest in a given stock market. Nevertheless, if one can purchase quality stocks at good prices in such a market, the currency’s weakness provides an additional benefit, reducing downside risk while increasing potential returns.

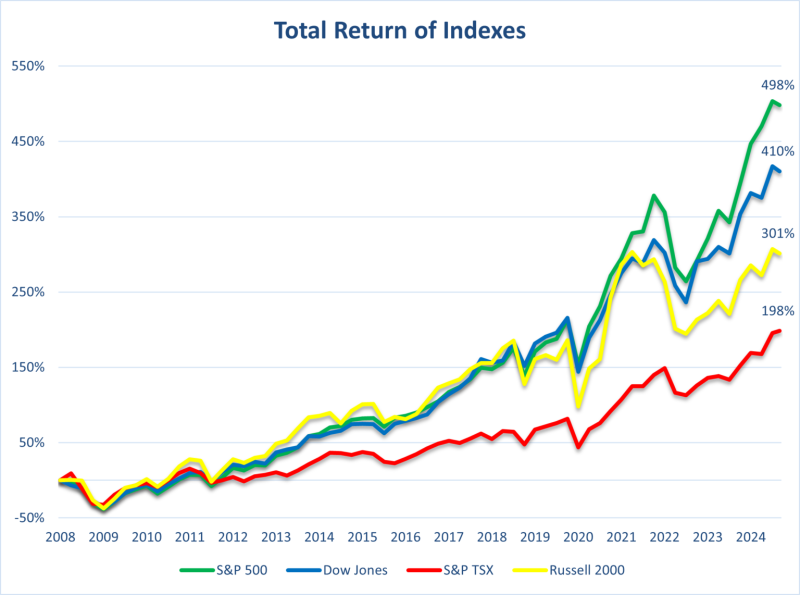

Secondly, the Canadian stock market has underperformed compared to the U.S. market for many years. Here is a comparison of the Canadian S&P/TSX index with U.S. indices — the S&P 500, Dow Jones Industrial Average, and Russell 2000 — from 2009 to today:

The S&P 500’s dominance over the other indices is evident, and it’s clear that U.S. markets have significantly outperformed the Canadian market.

Thirdly, based on projected 2024 earnings, the TSX is considerably less expensive than U.S. stock indices: it trades at around 17.1 times projected 2024 earnings, compared to 24.2 for the S&P 500 and 21.8 for the Dow Jones Industrial Average.

While this all sounds promising, it’s important to acknowledge that the underperformance of the Canadian market (and probably the Canadian currency as well) is largely justified. The U.S. market is more dynamic and includes a greater number of companies in growth sectors like technology, healthcare, and services. Furthermore, its economy has grown more quickly than Canada’s over the past 15 years (an average of 2.1% in the U.S. compared to 1.8% in Canada). The Canadian market, in contrast, remains dominated by the natural resources and financial sectors, which make up over 60% of the TSX index.

Moreover, the selection of quality companies is much more limited in Canada than in the United States. Consequently, due to a scarcity effect, shares of quality Canadian companies often trade at a premium compared to similar U.S. companies.

All things considered, when faced with two roughly equivalent opportunities, I would prefer a Canadian stock over an American one.

Philippe Le Blanc, CFA, MBA

Chief Investment Officer at COTE 100

_______

Philippe Le Blanc’s Blog is published in