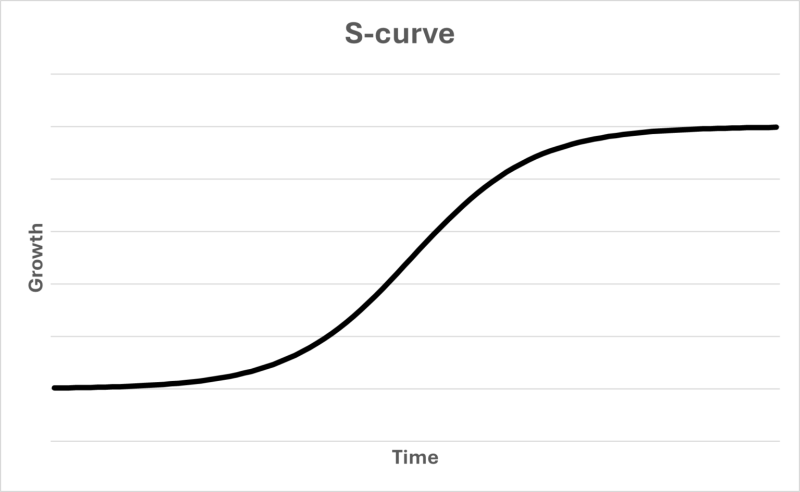

However, there are not only advantages. Over time, a company’s increasing size inevitably becomes a hindrance to its growth. This phenomenon has led to the creation of the famous “S-curve” that characterizes the growth evolution of most companies.

One of the major challenges facing any growing company is bureaucracy. I recently read that Amazon, known for years for its growth and agility driven by entrepreneurial spirit, has declared war on bureaucracy. Its CEO, Andy Jassy, wants to put an end to the “pre-meetings before the pre-meetings that precede the meeting where decisions are made.”

If Amazon sees bureaucracy as a problem, all business leaders and stock investors should take note. I will once again refer to Berkshire Hathaway, a company that, in my opinion, has largely avoided bureaucratization so far. Moreover, its leaders, Warren Buffett and Charlie Munger, have often discussed the challenge posed by bureaucracy for large companies at their annual meetings. Here are some quotes from Munger on this topic:

“Bureaucracy is like a cancer that inevitably grows to strangle efficient businesses.“

“In any large organization, the key is to avoid stupid bureaucracy. The more significant the bureaucracy, the slower the decision-making and the worse the outcomes.“

“Once you create a bureaucracy, you can’t get rid of it. Bureaucracies aren’t made to shrink.“

What are the solutions to reduce the risk of this “cancer”?

Once again, I look to Berkshire Hathaway for inspiration. The company is now worth more than $1 trillion on the stock market. In its 2023 annual report, we see that the company had 396,440 employees. And how many at its Omaha headquarters? 26. Lean and efficient.

Berkshire’s organizational model is highly decentralized. Buffett grants full management autonomy to the leaders of his many businesses. He has said, “We delegate almost to the point of abdication.” It is essential to bring decision-makers closer to a company’s customers.

Accountability in decision-making is, in my view, another crucial element. It’s important to divide teams into smaller units and make them responsible for their results.

It is not easy for an investor to detect the potential spread of the cancer of bureaucracy in one of their companies. In fact, a characteristic of bureaucracy is that it spreads insidiously. However, I believe it is possible to identify it in certain financial statistics of a company, but only over several years:

- A slowdown in revenue growth rate;

- Erosion of operating margins (EBITDA);

- A decline in the average return on invested capital (ROIC);

- A decrease in company revenue per employee.

More generally, you may also detect a decline in a company’s dynamism, its ability to innovate, launch new products or services, and stand out from competitors. You might also notice a growing distance from its customers, and a reduced ability to respond quickly and effectively to their demands and needs.

Philippe Le Blanc, CFA, MBA

Chief Investment Officer at COTE 100

_______