One podcast I enjoy is called Acquired, hosted by Ben Gilbert and David Rosenthal. The goal of the podcast is to explore the genesis and evolution of a well-known company. For example, the most recent episode focused on Starbucks and its founder, Howard Schultz. I greatly appreciate Acquired’s podcasts because they allow me to understand the challenges companies face as they grow. I also learn more about their leaders and their good and bad decisions. I then try to draw parallels with other publicly traded companies.

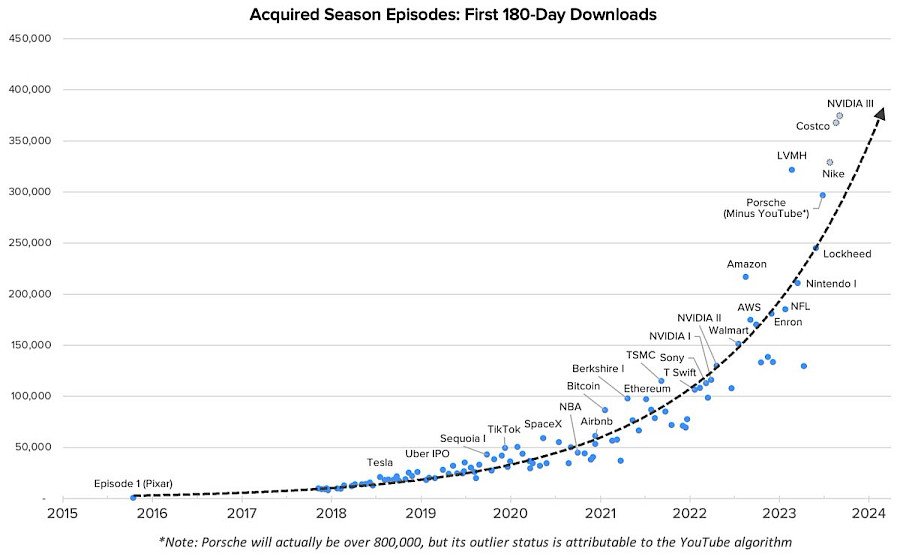

Ben and David have produced 192 episodes since 2015, and each new episode gets over 700,000 listens. Last October, Ben Gilbert posted an interesting graph on his X (Twitter) account. The graph below shows the growth in the number of downloads over the 180 days following the release of a new episode:

Upon seeing this graph, I immediately saw parallels with the world of investing.

Quality

If you go back and listen to the early episodes from 2015, you’ll notice that the quality of the content has drastically improved over the years. The early episodes were only 40 minutes long; today, they last between three and four hours. Initially, the hosts would study the featured company for five to ten hours; today, their research takes nearly 100 hours. Additionally, the audio quality of the editing has significantly improved.

The concept of “quality” is always present in our minds when we evaluate a company on the stock market. It can manifest in various forms: the quality of the leaders, the quality of the products and services offered, and the quality of the business model. Ideally, to improve our chances of success, these three components should be present in the companies we hold in our portfolio.

In the case of Acquired, the overall quality of the product has certainly contributed to its success.

Patience

At the start of 2018, Acquired already had 50 episodes. If we rely on the graph above, we estimate that the podcasts were getting around 10,000 listens per episode at that time. That was good, but far from being among the most popular podcasts on the web.

Whether in business or on the stock market, one generally must be patient before achieving success. Instant successes exist, but they are not the norm. As an investor, you need to give leaders time to execute their strategy and grow their business.

Compound Interest

In my opinion, the most important concept an investor should master is compound interest. Its beauty lies in the fact that growth is cumulative.

By examining the graph above, we see that the number of listeners has almost doubled every year for the past eight years. Thus, from 2017 to 2018, the number of listeners went from around 5,000 to 10,000. From 2018 to 2019, the number went from 10,000 to 20,000. In both cases, the growth is 100%, but the number of listeners added is quite different.

Indeed, from 2023 to 2024, the growth is still 100%, but the addition of 200,000 listeners is considerable. To achieve such a feat, Ben and David have relied on listeners acquired over the years since the podcast’s launch.

The concept of compound interest is directly related to the previously mentioned concepts. If you choose a quality stock and are patient, you have a chance to benefit from the magic of compound interest. For an investor to fully benefit, he needs to sit on his hands and let time do its work.

Although it sounds simple, it’s not always easy to achieve. If it were, all podcasts would have hundreds of thousands of listeners and all investors would be millionaires.

_______