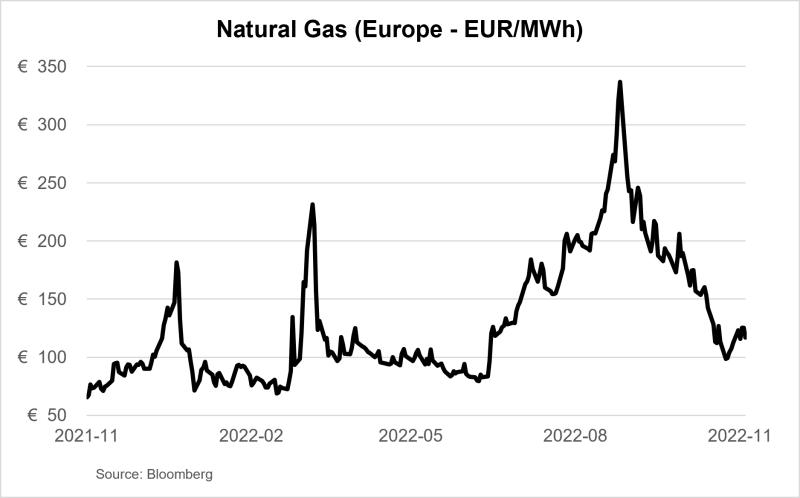

“What is the price of natural gas these days in Europe? Is it nearing its peak?”

I bet most of you will have answered that it is near its peak and has risen sharply since the start of the war in Ukraine. Isn’t that what has been making headlines for the past few months?

However, this is not the case, as evidenced by the graph below illustrating the evolution of the price of natural gas in Europe in recent months:

Isn’t it amazing that the price of gas has almost returned to its pre-conflict level? Moreover, the same observation could be made for the price of oil.

However, while the media had been raising the alarm that the price of gas shattered records last September, they were practically silent about its subsequent decline.

This is, in my opinion, a characteristic of the media: they love negative and sensational news. Bad news captures our attention more than good news. It is precisely this instinct of negativity that the media targets by constantly presenting suffering in the world, wherever and whenever it is. Good news often goes unreported.

In his book Factfulness, author Hans Rosling wrote that “Factfulness is recognizing when we get negative news and remembering that information about bad events is much more likely to reach us. When things are getting better, we often don’t hear about them. This gives us a systematically too-negative impression of the world around us, which is very stressful. To control the negativity instinct, expect bad news.”

The example of the price of natural gas is one of many. However, I believe that the news of the last few months has been particularly pessimistic regarding the economy and the stock markets, as we are swimming in the midst of a bear market, inflation is at record highs and most observers are anticipating a recession.

Most of us suffer from this negativity instinct identified by Hans Rosling in his book, which is constantly fed by the media. For the long-term investor, it is important to remember this and take a more factual and historical perspective.