This is especially true during periods of high inflation, as has been the case for several months now. The most recent statistic shows a consumer price index up 8.5% in the United States in March 2022 compared to a year earlier. This is the highest level of inflation in the past 40 years.

Historically, the inflation rate has been around 3% per year. This is significant: after nearly 25 years, this means that a basket of goods costs more than double.

If any investor’s goal is to outperform or at least equalize the rate of inflation over the long term, what are the best options?

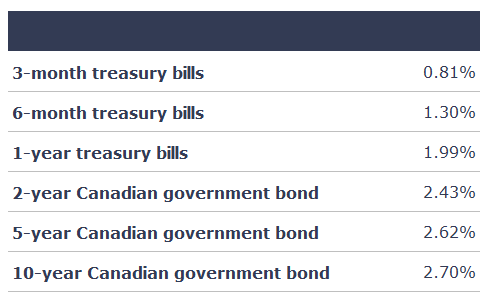

First, here is what some Canadian government bonds of various maturities currently offer:

Although these rates have risen considerably in recent months, investors should consider whether such investments will allow them to at least match the rates of inflation over the next few years. It seems to me that this is unlikely and that is without considering the possibility that investors will pay taxes on the interest received if they invest in a taxable account.

But even discounting the particularly anemic yields offered by bonds in recent years, the yields offered by bonds historically have barely managed to outpace inflation.

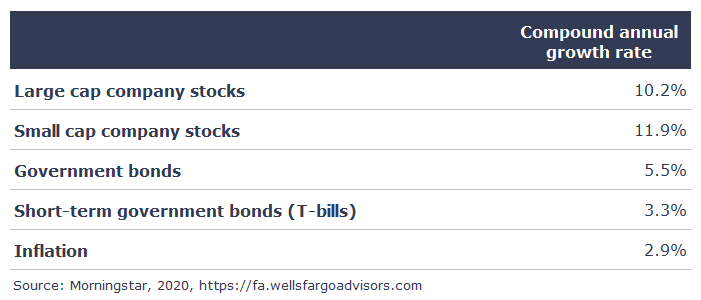

In contrast, equities have historically offered much more attractive returns than fixed income investments. As proof, here are the returns of various US investment categories for the period from 1926 to 2019 according to Morningstar:

In my opinion, stocks offer the best protection against the ravages of inflation. However, to take advantage of their superior long-term returns, the investor will have to be prepared to live with high short-term volatility and, on occasion, sharp corrections. This is why I have always advocated investing in the stocks of quality companies for the long term and remaining present on the stock market at all times, even when the conditions appear unfavourable.