As I mentioned, I made my life easier by focusing solely on the COTE 100 Financial Bulletin’s Canadian portfolio of 17 stocks.

But there was an issue: what if one of the companies in the portfolio was bought (takeover bid)? This was indeed the case for three of the 17 companies in the portfolio over the 10 years following 2012. I opted to reinvest the sums obtained during takeover bids to buy back, in the same currency, each of the remaining positions of the portfolio according to their percentage of the portfolio at the time of the takeover.

Thus, as indicated, the portfolio recorded a compound annual return of 12.2%, a good performance!

How does that return compared to that of the COTE 100 Financial Bulletin portfolio for the same period?

I would first remind you that this portfolio is real and that it has been managed by COTE 100 since the very beginnings of the Financial Bulletin in 1988. Most of the stocks recommended in the Bulletin are purchased there. The portfolio pays transaction fees, receives dividends and interest.

Another issue is that the objective of the Financial Bulletin is to recommend the purchase of stocks to its subscribers. Most of them are purchased in the portfolio, which implies greater stock turnover than for our traditional management.

Upon closer inspection, it became clear that we needed to look at the Bulletin’s entire portfolio, the Canadian portfolio, and the US portfolio, to be able to compare its actual returns with those of a hypothetical portfolio where we would have done “nothing” for 10 years (the same rules apply regarding takeover bids).

This portfolio includes 17 Canadian stocks and 16 American stocks.

First, this portfolio of 33 securities recorded a compound annual return of 12.6% from December 31, 2012, to December 31, 2022. An excellent performance which indicates that the portfolio of American stocks has done slightly better than the Canadian, in part due to the appreciation of the US dollar against the Canadian dollar. In addition, six companies in the portfolio were the subject of takeover bids during the period. None went bankrupt.

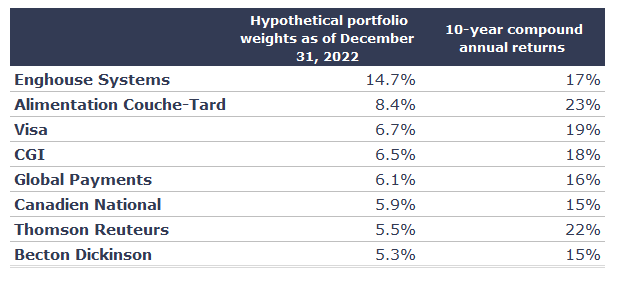

After 10 years, the portfolio would have reflected the excellent stock market performance of a few stocks and the rather mediocre or disappointing performance of a few others. Thus, the stocks that performed best on the stock market would have monopolized a significant share of the portfolio after 10 years. Here they are, along with their hypothetical portfolio weights as of December 31, 2022 ans their 10-year compound annual returns (dividends included):

During the same period, the COTE 100 Bulletin portfolio (managed by COTE 100) obtained a compound annual return of 12.9%, slightly better than the hypothetical portfolio.

Is a 0.3% compound annual return worth all the work behind the deals done over the past 10 years?

Some would say no. However, I would say yes, for two reasons.

On the one hand, risk management is an integral part of managing a portfolio. For example, would I be comfortable with 14.7% of the hypothetical portfolio invested in Enghouse Systems? No. In the real portfolio, this stock represents 5.4%. In fact, the longer the exercise (20 years or 30 years), the more the portfolio would have naturally concentrated on a few stocks – we would probably have ended up with weightings of the order of 25% or more in a few stocks.

Furthermore, as I said above, the Bulletin requires us to carry out more transactions to regularly recommend new stocks to its subscribers. We do not have this constraint in the management of our portfolios.