Stock markets have taken a serious nosedive over the past week. As of August 25, the Canadian S&P/TSX was down 16.0% compared to its latest peak reached in September 2014. The American S&P 500 had lost 12.4% since May 2015. Technically, we can therefore speak of a “correction”, which is defined as a drop of 10% to 20% of an index compared to its recent peak (a drop of more than 20% represents a bear market).

In my opinion, stock market corrections are completely normal. They are part of the lives of all investors. What was abnormal was that the North American stock market had not experienced such a correction for almost 4 years, the last dating back to the summer of 2011 and the crisis of raising the American government debt ceiling. The American market then plunged 17.6% from its peak.

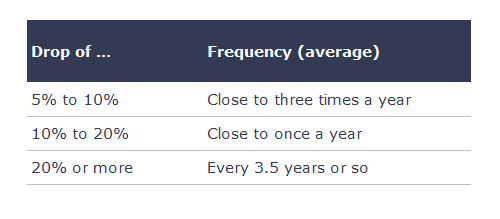

I am taking this opportunity to highlight some interesting statistics concerning the declines in the Dow Jones Industrial Average index for the period from 1900 to 2013 (source Capital Research and Management Company). These statistics illustrate very well the frequency of stock market corrections.

Despite the frequency of corrections, the stock market remains profitable in the long term. The compound annual return of the S&P 500 over the past 30 years is 8.2%.

Volatility and frequent corrections are therefore normal. I would even add that each time, it seems that the reason justifying the correction is entirely plausible. At the moment, the Chinese economy is slowing; four years ago, it was the apparent inability of the US Congress to agree to raise the country’s debt ceiling.

And yet, despite all the ups and downs, stock markets continue to grow in the long term. It therefore seems clear to me that the worst thing to do when a correction occurs is to panic and sell your stocks. Don’t look too closely at the daily fluctuations in your portfolio. Even better: show courage and take advantage of the drop in several quality stocks to buy some!