From the outset, it is not so easy to go back. If you had a portfolio 30 years ago, it’s a good bet that many of the companies in the portfolio from that time disappeared afterwards, either the company was bought (takeover) or the company went bankrupt. In both cases, it becomes difficult to go back in time to obtain precise data.

However, I have taken the first steps to go back in time using the example of the portfolio of the COTE 100 Financial Bulletin, which has existed since 1988. First, I used the Canadian portfolio of the COTE 100 Financial Bulletin as of December 31, 2012. The reason is that it significantly simplifies the exercise. I also believe this is a good sampling that gives a good idea of what the portfolio would have been doing for 10 years.

The assumptions used are as follows:

- No transactions, no purchases, or sales of securities for 10 years.

- The only exception to this rule occurs when one of the securities in the portfolio is acquired through a takeover bid. In such a case, we have assumed that the proceeds from the sale of the security will have been reinvested in the same month in the remaining securities in the portfolio according to the weightings of each security at that precise moment.

- Dividends received were reinvested in the same security.

- We excluded portfolio cash from our calculations, which represented 7%.

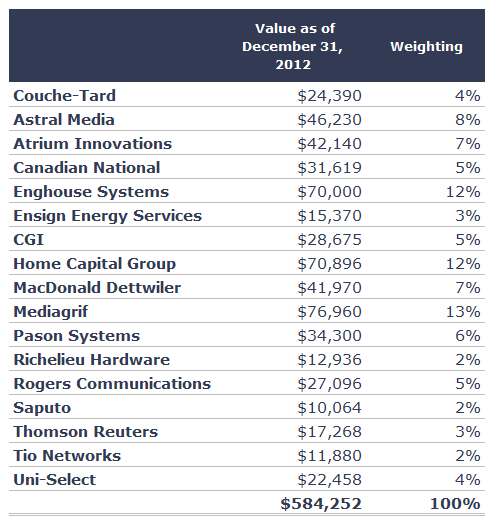

Here is the Canadian portfolio of the Financial Bulletin as of December 31, 2012 (excluding cash).

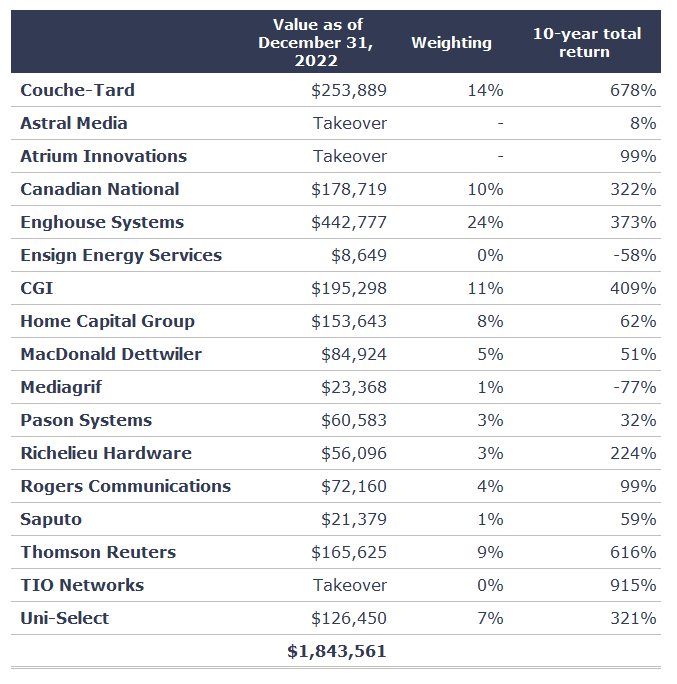

Now here is what the portfolio would have been like as of December 31, 2022, if we had followed the guidelines listed above:

The value of the portfolio would therefore have been multiplied by nearly 3.15, which translates into a compound annual return of 12.2%, an excellent return!

First, I am happy to note that none of the 17 companies in the portfolio as of December 31, 2022, have gone bankrupt! I believe this is because we have always concentrated our investments in companies that are profitable and in good financial health.

Second, three of the 17 companies in the portfolio were subject to takeover bids during the period: Astral Media, Atrium Innovations and TIO Networks.

Also, of the 14 remaining stocks, six were big winners (300% or more), two were bad investments (negative return), while the rest (six) generated ordinary returns.

Finally, we can see that as of December 31, 2022, the portfolio would have been somewhat unbalanced. For example, the weight of the portfolio in the Enghouse stock would be 24% and that of Couche-Tard 14.0%. These are most likely weights that are too high for the majority of investors.

The bottom line: a few big winners in a long-lived portfolio will more than make up for the few losing stocks. There is no need to trade too much – the only reason for doing so should be with the objective of keeping its winners and getting rid of stocks from companies that don’t deliver the goods.

Next week, I will try to see if the purchases and sales we have made over the past 10 years in the COTE 100 Financial Letter portfolio have added value… or not.