“Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years. So I think — the market is about 3,800 today, or 3,700 — I’m pretty convinced the next 3,800 points will be up; it won’t be down. The next 500 points, the next 600 points — I don’t know which way they’ll go. So, the markets ought to double in the next eight or nine years. They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That’s all there is to it.”

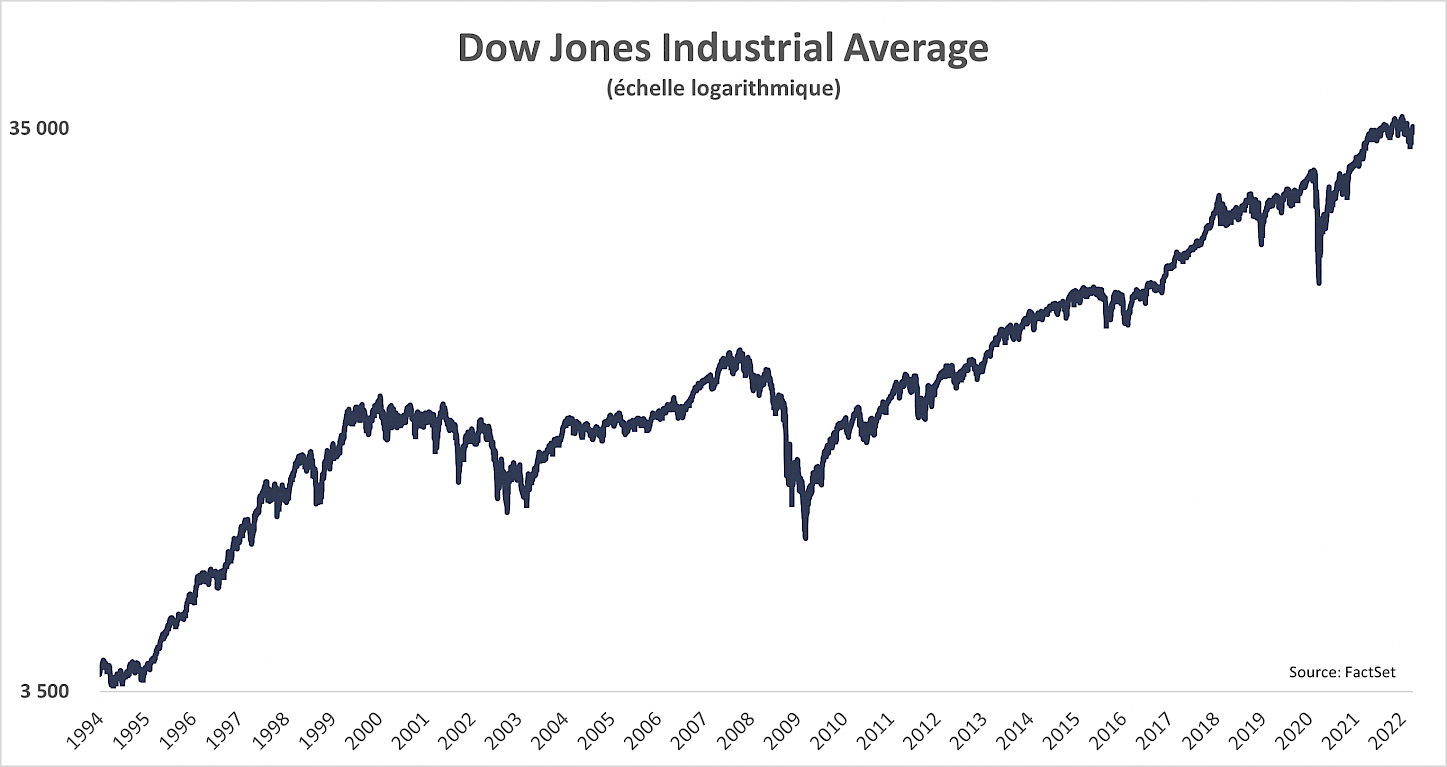

Was Peter Lynch right? In 1994, as he points out, the Dow Jones Industrial Average was near 3,800. Today, it’s near 35,300. That’s a compound annual return of 8.4%, which is very close to Peter Lynch’s estimate of earnings growth 27½ years ago!

This is, in my opinion, a good proof that simplicity is a much better guide. Why must investors always complicate their lives so much? Stock market investing is simple: you invest either in quality companies at a reasonable price or in stock market indices, and you sit very wisely on these investments for many years. Anyone who invested $10,000 in October 1994 would have close to $82,900 today. In another ten years, assuming that the 8% growth rate is maintained, this sum should approach $179,000 and in twenty years, more than $386,000.

When Peter Lynch said, “something will come out of left field”, he certainly wasn’t thinking of the COVID-19 pandemic that hit the stock markets in March 2020 or Russia’s invasion of Ukraine in February 2022. It is precisely the kind of unpredictable events that occur sporadically and cause stock markets to fall. But in the long term, such events become less important in the face of the almost uninterrupted march of economic growth and corporate profits. Look at the evolution of the Dow Jones Industrial Average index from 1994 to today and try to identify the crises that caused it to fall:

In my opinion, the main drops of the index since 1994 correspond to the following crises:

- 1998: Russian financial crisis (default on domestic debt and devaluation of the rouble)

- 2000: Burst of the technology bubble

- 2001: September 11

- 2008-2009: The American financial crisis

- 2020: COVID-19 pandemic

- 2022: Russo-Ukrainian War

Over the long term, corporate profits will continue to grow, and stocks will follow this progression fairly faithfully.