Should an investor wishing to be successful trust these recommendations? My answer: yes and no. Here’s why.

Yes

Financial analysts are generally assigned to a sector and are able to clearly identify its growth prospects and its risks. So, I believe that investors are well advised to read research reports for more information.

However, I suspect that many do-it-yourself investors buy stocks without even researching the underlying companies. I don’t believe these reports are a substitute for thorough research, but they are a step in the right direction. These reports often summarize the situation well and save the investor time.

The most interesting reports are those where the analyst initiates the monitoring of a stock. Before presenting its first recommendation, a first report, consisting of dozens of pages, provides a complete overview of the company and its industry.

In an ideal world, investors should do some personal research and conclude their work by reviewing the research reports. This way of doing things will make it easier for him to identify the elements that he could have missed or understood less well.

No

My least favorite part of research reports is the price target set on a security. First, I have the impression that analysts often adjust their target price according to the stock price. Without naming the company and the analyst, here is a concrete example of what I see happen too often with target prices:

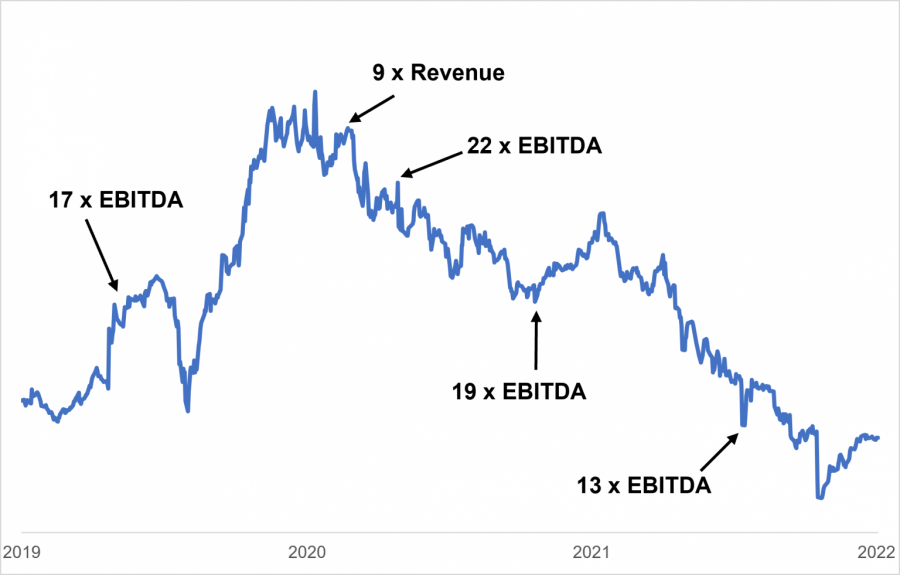

Initially, the analyst values the company based on its operating earnings (17 times EBITDA). In the third quarter of 2020, he changes its model and uses a valuation based on revenue (9 times revenue). The following quarter, he uses operating profits again (22 times EBITDA). I could be wrong, but I feel like this adjustment is made to adjust to the price of the stock.

Generally, the stock price reflects the value of a company quite well; it is therefore normal to see the multiples improve or deteriorate depending on the results and the stock price. However, I question the relevance of the changes made to the valuation model above.

On another note, target prices are usually a forecast of the value of the security in 12 to 18 months. An investor who adopts a style similar to ours should not worry so much about the price of a security in a year but think more long term.

The objective of a long-term investor is to buy, at a reasonable price, a part of a company whose profits are virtually certain to be substantially higher in 5, 10 and 20 years. Since analysts’ price targets are often based on expected earnings one year from now, their use is short-term.

In my opinion, target prices give a general idea of whether a security is over- or undervalued, but they don’t tell us anything about the long-term potential. What interests me is the potential price of a security in 10 years, not in one year.

Conflicts of interest?

Have you ever noticed that most “sell-side” analysts recommend buying a stock? In March 2021, FactSet studied 10,374 recommendations on S&P 500 stocks. At that time, 55% of recommendations were buys while only 7% were sell recommendations. The others recommended holding the stock. However, at that time, our investment team had difficulty finding interesting opportunities.

This high level of buy recommendations raises the topic of conflicts of interest between research reports and the capital markets activities of banks and brokerage firms. Companies wishing to issue equity or debt will often lean towards banks that issue favourable reports on their stock. I guess it must be difficult to get the mandate to issue shares when the in-house analyst recommends the sale of the stock.

We must not generalize. The risks of conflicts of interest are better regulated today than in the past. Many analysis reports are relevant. I therefore suggest that you take advantage of the work of analysts to understand, validate and question your own investment thesis. For the evaluation of a stock and the final recommendation, pass over it quickly and form your own opinion.

Jean-Philippe Legault, CFA

Financial analyst