In this book, Marks presents a chart to help investors navigate the stock market cycle. For Marks, we cannot predict the future, but we can try to understand what is happening in the present. Where are we in the economic cycle? Where do we stand in stock market cycles? Approximately where do we stand in the cycle of investor emotions?

Given the upheavals that have occurred in recent months, in both the economy and the stock markets, I believe that the time is right to redo the exercise.

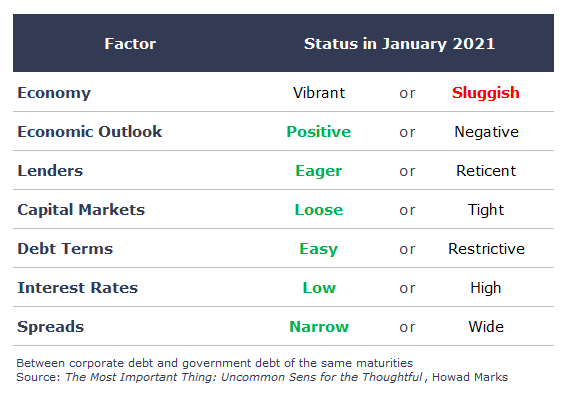

Let’s first go back to my analysis of the state of the market carried out in January 2021. Here is how I had filled in Mr. Marks’ table at that time:

Remember: we were trying to come out of the pandemic at that time and the economy was still in a sluggish and uncertain state. On the other hand, all other factors were “favourable” to a strong economic recovery. Interest rates were very low, the stock market was at its peak, and capital markets were in turmoil.

However, this is precisely what has happened since then. In fact, the growth was such that it created a strong overheating of the economy which resulted in an explosion of inflation.

Here is how I would fill in the table today:

Isn’t it interesting that each factor has flipped 180 degrees!

However, there is a caveat: for several of the factors listed, I checked on the right, but it is often a question of interpretation. Lenders are more reticent than at the start of 2021, but are they reticent by the historical norm?

One thing is clear, however: economic conditions have changed dramatically in recent months. Let’s look at some of the factors:

1. Economy and economic outlook: it remains vibrant, but the majority of observers anticipate that this situation cannot last very long. An economic slowdown, or even a recession, seems more than likely in the coming months due to the sharp rise in interest rates observed in recent months and which will continue in the months to come.

2. As for the state of the capital markets, I believe that we will soon be able to see from the results of North American banks how much this segment of their activities has slowed in recent months. A telling statistic, compiled by stockanalysis.com, is the number of companies that have made the leap to the stock market, initial public offerings (IPOs):

3. As for interest rates, we all know that they have risen significantly in recent weeks. The rate of a 10-year US government bond is currently close to 3.45%, compared to 1.5% at the end of 2021. In addition, the average rate of a BAA-rated corporate bond currently stands at 5.48%, compared to 3.37% at the end of 2021.

According to Marks, and I agree with him, if for most of the factors in his chart you tick the left column, caution is in order. This was clearly the case in January 2021.

If, on the contrary, you tick most of the conditions in the right column, you are probably in front of a great opportunity to invest at a good price. I think that’s the case today.

The best opportunities arise when conditions appear most uncertain and least favourable. It seems to me that we are approaching that state. Perhaps these conditions will continue to deteriorate for some time to come, but it seems to me that the sharp stock market correction over the past few months is already discounting a very pessimistic scenario.